nebraska sales tax rate changes

Old rates were last updated on 412021. Geneva collects the maximum legal local sales tax.

General Fund Receipts Nebraska Department Of Revenue

Although many changes have been made in the sales tax since 1967 one of the most significant was the 1983 elimination of the sales tax on food for home consumption.

. Detailed Nebraska state income tax rates and brackets are available on this page. 2022 Nebraska Sales Tax Changes Over the past year there have been nineteen local sales tax rate changes in Nebraska. Because this paper recommends reducing Nebraskas state sales tax rate as part of comprehensive tax reform it would be essential for policymakers to be able to assess the cost of these changes.

The state sales tax rate in Nebraska is 55 but you can customize this table as needed. Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. Sales and use tax in the city of St.

For tax rates in other cities see Nebraska sales taxes by city and county. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. The 75 sales tax rate in Geneva consists of 55 Nebraska state sales tax and 2 Geneva tax.

Motor Fuels Tax Rate. Changes in Local Sales and Use Tax Rates Effective January 1 2021. The following are recent sales tax rate changes in Nebraska.

The Total Rate column has an for those municipalities. Local sales and use tax rate changes have been announced for Nebraska effective October 1 2015. Fordyce will start a city sales and use tax rate of 1 Spalding will start a city sales and use tax rate of 15 Gibbon Guide Rock and Hartington will each increase its rate from 1 to 15 and.

New rates were last updated on 712021. A new 05 local sales and use tax takes effect bringing the combined rate to 6. Local Sales and Use Tax Rates Effective April 1 2021 Dakota County and Gage County each impose a tax rate of 05.

When a tax rate is changed economists calculate how much the tax will either increase or decrease the. You can print a 75 sales tax table here. Edward will increase by 15 bringing the combined rate to 7.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. No credit card required. 2018 Charitable Gaming Annual Report.

More are slated for April 1 2019. The corporate tax rate for the first 100000 of Nebraska taxable income remains. The 6 sales tax rate in Homer consists of 55 Nebraska state sales tax and 05 Dakota County sales tax.

For tax rates in other cities see Nebraska sales taxes by city and county. A new 1 local sales and use tax is being imposed in the following locations bringing the total state and local rate in each to 65. January 2019 sales tax changes.

There is no applicable county tax or special tax. You can print a 6 sales tax table here. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use tax bringing the total sales and use tax rate in each city to 65. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. The local sales and use tax rate in Chadron will increase from 15 to 2.

Hubbard is levying a 15 local tax bringing the. Corporate Tax Rate Change LB 432 For taxable years beginning on or after January 1 2022 LB 432 reduces the corporate tax rate for Nebraska taxable income in excess of 100000 from 781 to 750 in tax year 2022 and to 725 for tax year 2023 and beyond. Returns for small business Free automated sales tax filing for small businesses for up to 60 days.

Several local sales and use tax rate changes will take effect in Nebraska on April 1 2019. In Lincoln the local sales and use tax rate will jump from 15 to 175. Several local sales and use tax rate changes took effect in Nebraska on January 1 2019.

Nebraska Department of Revenue. See the County Sales and Use Tax Rates section at the end of this listing for information on how these counties are treated differently. There is no applicable county tax or special tax.

The Waverly Nebraska sales tax rate of 7 applies in the zip code 68462. FEBRUARY 25 2021 LINCOLN NEB Tax Commissioner Tony Fulton announced the following changes that will be effective as of April 1 2021. Nebraska Sales Tax Rate Finder.

Revenue Impact of a Sales Tax Rate Change. The Nebraska income tax has four tax brackets with a maximum marginal income tax of 684 as of 2022. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax.

There is no applicable city tax or special tax. Remember that zip code boundaries dont always match up with political boundaries like Waverly or Lancaster County so you shouldnt always rely on something as imprecise as zip codes to determine the. There are approximately 3253 people living in the Waverly area.

The Nebraska state sales and use tax rate is 55 055. You can print a 725 sales tax table here. For tax rates in other cities see Nebraska sales taxes by city and county.

New local sales and use taxes.

Compared To Rivals Nebraska Takes More From Taxpayers

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

Taxes And Spending In Nebraska

General Fund Receipts Nebraska Department Of Revenue

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax By State Is Saas Taxable Taxjar

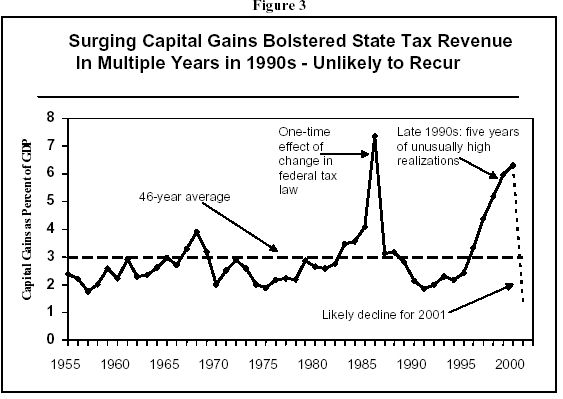

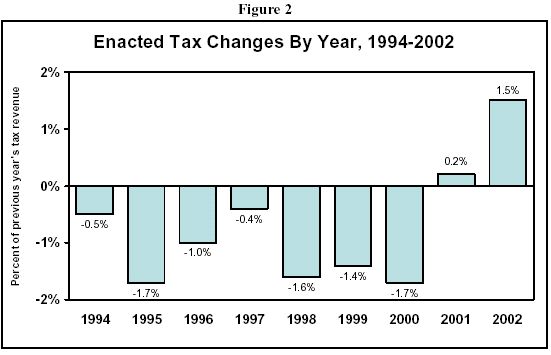

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

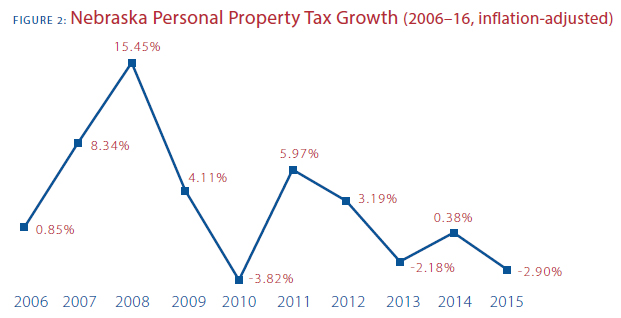

2020 Nebraska Property Tax Issues Agricultural Economics

Compared To Rivals Nebraska Takes More From Taxpayers

This Time It S Personal Nebraska S Personal Property Tax

Taxes And Spending In Nebraska

Are State Taxes Becoming More Regressive Rev 10 29 97

Nebraska Sales Tax Rates By City County 2022

Nebraska Tax Rates Rankings Nebraska State Taxes Tax Foundation

When Did Your State Adopt Its Sales Tax Tax Foundation

States With Highest And Lowest Sales Tax Rates

The Top Tax Rate Has Been Cut Six Times Since 1980 Usually With Democrats Help The Washington Post