carried interest tax rate 2021

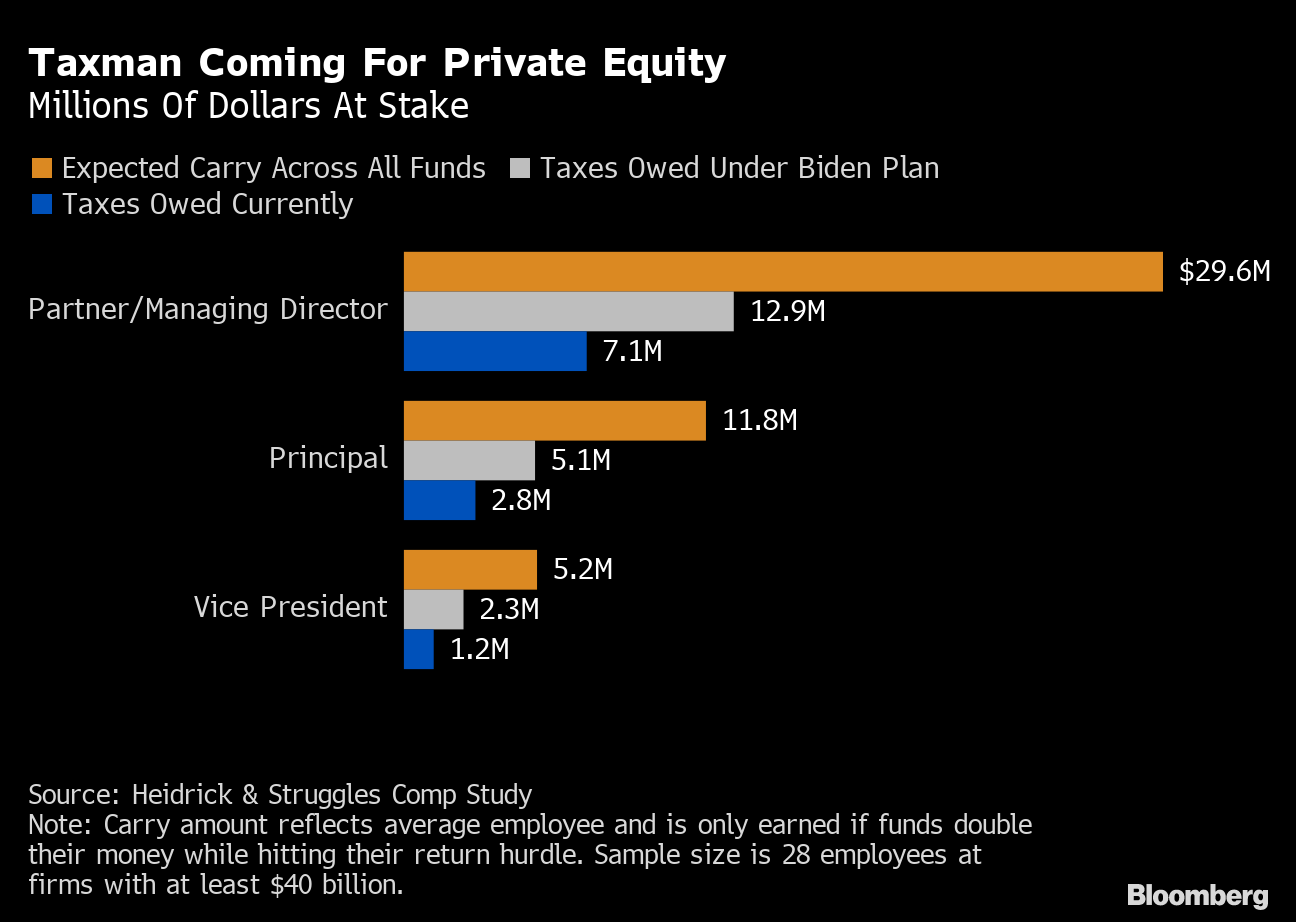

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. President Joe Bidens plans would tax carried interest which private equity managers earn from the investments they make at rates as high as 396 against 20 today.

Carried Interest Tax Break For Private Equity Survives Another Attempt To Kill It Barron S

The Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 passed its.

. Carried Interest Fairness Act of 2021 Senators Baldwin Manchin and Brown. Trump then signed the 2017 tax bill and failed to keep his promise to eliminate the tax break for wealthy hedge fund managers. This bill modifies the tax treatment of carried interest which is compensation that is typically received by a partner of a private equity.

Tax incentives include 0 tax rate for carried interest. Ad Knowing The Tax Brackets for 2023 Can Help You Implement Smart Tax Strategies. Every president since George W.

The Carried Interest Exemption. Ad Explore the Most Up-to-date Data on Us State and Federal Taxes with Usafacts. Carried Interest Fairness Act of 2021.

Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the Internal Revenue. In January 2021 the US. TaxInterest is the standard that helps you calculate the correct amounts.

The fund would also need to apply to. House Democrats Float 265 Top Corporate Rate in Tax Blueprint. Proceeds from that individuals partnership interest are often taxed as capital gain rather than ordinary income.

The sole reason the carried interest loophole survives is fierce lobbying by the private equity industry. On January 7 2021 the Department of the Treasury and the IRS issued final regulations under Section 1061 of the Internal Revenue Code regarding the taxation of carried. If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed.

The lawmakers provided this example. Tue 14 Dec 2021 0610 EST Last modified on Tue 14 Dec. Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead.

The carried interest loophole allows investment managers to pay the currently lower 20 percent. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. Where the DIMF rules apply amounts which are in substance management fees are subject to tax as trading income regardless of the underlying.

As many of you are probably aware on August 14th 2020 Department of Treasury published proposed regulations under Section 1061 of the Internal Revenue Code IRC. The Congressional Budget Office has estimated that taxing carried interest as ordinary income. The law known as the Tax Cuts and Jobs Act PL.

The tax framework would apply to carried interest paid by a fund that is subject to the definition a fund in the unified fund exemption rules. President Bidens American Families Plan calls on. Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues.

What The Proposed Tax Plan Means For Commercial Real Estate Voit Real Estate Services

What Carried Interest Is And How It Benefits High Income Taxpayers

What You Need To Know About Capital Gains Tax

Summary Of Fy 2022 Tax Proposals By The Biden Administration

What You Need To Know About Capital Gains Tax

What Kyrsten Sinema S Tax Provision Cut Means For Rich Investors

Venture Investors Shrug At Proposed Changes To Us Carried Interest Taxation Techcrunch

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Biden S Carried Interest Tax Proposal Could Put Fund Managers In Sec S Sights Thinkadvisor

Investment Expenses What S Tax Deductible Charles Schwab

How Are Capital Gains Taxed Tax Policy Center

State Taxes On Capital Gains Center On Budget And Policy Priorities

What Carried Interest Is And How It Benefits High Income Taxpayers

The Great Compression Middle Market Growth

What Is Carried Interest And How Is It Taxed Tax Policy Center

The Carried Interest Debate Is Mostly Overblown Tax Foundation

Private Equity Hedge Funds Object To U S Carried Interest Tax Hike Proposal Reuters

:max_bytes(150000):strip_icc()/4592-f64c21a16a3847538c094ee48dee34fe.jpg)